Single-entry bookkeeping is a simple and straightforward method of bookkeeping in which each transaction is recorded as a single-entry in a journal. This is a cash-based bookkeeping method that tracks incoming and outgoing cash in a journal. In order to choose single entry bookkeeping vs double entry the best financial process for your business, it’s important to understand the different types of bookkeeping systems. An efficient bookkeeping system is crucial to the success of a business since it measures the financial performance of the business.

If the latter is the case, then the virtual bookkeeper can enter the data, organize it, generate reports, and reconcile accounts. While single entry and double entry are the two most popular types of bookkeeping, there are also two other types of bookkeeping systems. These include computerized bookkeeping systems and virtual bookkeepers.

What is Double-Entry Accounting?

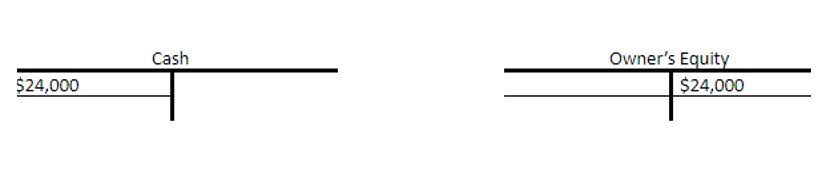

For small businesses, the single-entry bookkeeping system is preferred for convenience. For other types of businesses, the double-entry method may make more sense. Double-entry bookkeeping is an accounting system in which all financial transactions are recorded in two types of accounts, debits and credits. When you post a transaction, the number of debits and credits used can be different, but the total dollar amount of debits must equal credits. Zoho Books follows double entry bookkeeping as it is suitable for businesses of all sizes.

The procedure starts from source documents, followed by the journal, ledger, trial balance, then at the end financial statements are prepared. Essentially, the representation equates all uses of capital (assets) to all sources of capital (where debt capital leads to liabilities and equity capital leads to shareholders’ equity). For a company to keep accurate accounts, every single business transaction will be represented in at least two of the accounts.

Pros and Cons of Single-Entry Bookkeeping

This would be an issue for a larger company with numerous assets like vehicles, buildings, or office furniture. As for liabilities, it’s harder to monitor their effect with single-entry bookkeeping. Single-entry bookkeeping has one entry per transaction, while double-entry bookkeeping has two entries per transaction—a debit and a credit.

In the top row, record the starting balance for the period you’re accounting for. Then record each transaction with the date, description, and amount. Parentheses indicate outflows and non-bracketed numbers are inflows. At the end of the accounting period, just calculate the remaining balance. You also won’t need to invest in any bookkeeping software or services, as a simple Excel sheet is enough.

Golden Rules of Accounting

The transaction amount will either be a positive value (reflecting income) or a negative value (reflecting expenses). Even if your log has separate columns for revenue and expenses, you only record each transaction once in the relevant column. The next section in this guide on what is the difference between single-entry & double-entry bookkeeping is the definition of the latter one. To state simply, under the double-entry bookkeeping technique, a transaction is shown as debit at one book of account and credit at another. Each business transaction is listed in one column and is either positive or negative. It’s possible to split revenue and expenses into separate columns, but because each such accounting transaction is still recorded on a single line, this also qualifies as single-entry bookkeeping.

We go into more complex examples of double-entry accounting in different posts but for now, we will continue on and look at the key differences between single and double-entry accounting. Two types of accounting that new accountants will come across are single-entry bookkeeping and double-entry bookkeeping. Often these are referred to as single-entry accounting and double-entry accounting as well.